5% down payment Florida jumbo loans are back. These new 95% jumbo loan programs allow homebuyers to obtain mortgage financing that exceeds the conforming loan limits set by Fannie Mae and Freddie Mac.

With interest rates starting to come back down, some home buyers would like to consider a jumbo loan to get more house for their money. Even better is the 5% Florida jumbo loan does not require monthly mortgage insurance like many other loans with a low down payment. Below, we take a brief look at the jumbo loan basics and discuss all the things you need to know.

Have questions? Get answers 7 days a week by calling the number above.

NOTE: The 5% and 10% down options below are now available in all 50 states.

First, a jumbo mortgage is a home loan that exceeds the typical lending limits of the Federal Home Loan Mortgage Corporation (Freddie Mac), Federal National Mortgage Association (Fannie Mae), the Federal Housing Administration (FHA) or the Veterans Administration.

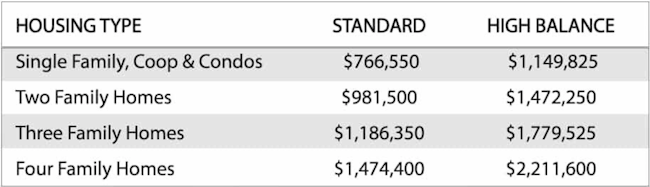

Loans sold to either Fannie or Freddie are called conventional loans or conforming loans because the mortgage amount “conforms” to the underwriting guidelines and lending limit of these companies. Loans above the following limits are called jumbo loans (there are expectations in select high-cost locations)

Until recently, jumbo home buyers had to put 10-20% down if they wanted to purchase a home and borrow over the conventional loan limit of $766,550. The new 5% down Jumbo mortgage with no monthly PMI is a great financing option for borrowers who want to purchase a home or refinance.

This program will allow approved buyers to purchase a home up to $2,000,000 with only 5% down, and have the option of No monthly PMI.

There are not many banks, lenders or mortgage companies offer this program today. This is especially good for borrowers in the high-priced luxury location like Miami, West Palm Beach, Naples, Coral Gables, Jupiter, Sarasota, Boca Raton, Cape Coral, St. Petersburg, Tampa, Orlando, etc.

A few notes for the 5% down payment Jumbo loans:

- 95% loan-to-value financing is only available for the borrower that can fully document income, assets, etc.

- For borrowers that cannot do full documentation, please check into our non-conventional loan programs here.

- To obtain the max 95% financing, borrowers will need a 680+ credit score. If the 95% loan is $1.5m-$2.0m the min credit score should be 740.

- The program can be used to purchase a single-family home, town home or condo.

- Jumbo interest rates can vary based on the term and credit score. Borrowers will choose between secure 30, 20, 15 fixed rate options or adjustable rate terms (ARM)

- Applicants can choose an interest rate buy-down or reduced closing costs options.

- Second homes, vacations home, and investment property purchases are permitted but will require a slightly higher down payment of 10% down or more.

- Jumbo rate-term, plus cash-out refinance options are available for homeowners that already have a high-cost mortgage.

- Higher loan amounts are available. Up to 90% LTV financing to $2,500,000 with 720+ credit score. Up to 85% LTV financing to $3,500,000 with 720+ credit score. Please contact us if you are financing over $4.0M.

Five Stars is a national Jumbo loan resource, and have specialists standing by 7 days a week to serve you. Please call ph: 888-705-1975, or just submit the “Request Contact” form located at the top of this page.

Ben David says

I am looking to get pre qualified for a 5% down jumbo loan. I have not chosen a house yet but just wanted to see what my options were as we expect to buy within the next 120 days. The home we will be purchasing will be in Jupiter Florida, 33458

National Mortgage says

Thanks for contacting us Ben. We will have a loan specialist contact you today with all the details on the 95% Jumbo program.

Paul says

Hello, I am looking to get info for a 5% down jumbo loan (est $600K). I have not chosen a house yet but just wanted to see what my options were as we expect to buy within the next 4-6 months . The home we will be purchasing will be in Orlando, FL.

Kenny D says

This jumbo loan program is available in Tampa, Hillsborough County? I plan to purchase a home around 650K in the next 3 months. The house will likely be in the Tampa area, maybe St. Petersburg.

National Mortgage says

Yes, the program is available to all qualified home buyers nationwide.

Kerry H says

Are there any 100% jumbo loans in Florida? I would prefer a no down payment option if available.

National Mortgage says

100% Jumbo mortgages are not available as of today. Please check the latest blog posts as guidelines and requirements do frequently change. Thank you for your question.

Jose L says

I would like to purchase a condo in Miami. Are condos ok for this program?

National Mortgage says

Yes, most condos are eligible to at least 90% loan to value. Many are also approved up to 95%.